Last night, several people expressed positive interest in the link to my blog Reinventing IS-LM: The IS-LM-NAC Model and How to Use It that I tweeted out it in response to this Sri Thiruvadanthai tweet at Matthew Boesler of Bloomberg.

Here is a way to make sense of IS-LM. The paper I discuss in the following post, Animal Spirits in a Monetary Model, was inspired by my own interactions with Axel. The theory in this paper is backed up by empirical work in my newly published paper Keynesian Economics without the Philips Curve, joint with Giovanni Nicolò. I greatly appreciate all those who are taking the time to read and process these papers and to look at the ideas expressed in them with fresh eyes and fresh enthusiasm. Together we are moving the Overton window.

Here is the original post: enjoy...

I have been critical of the IS-LM model in earlier posts. My paper with Konstantin Platonov fixes some of the more salient problems of IS-LM by reintroducing two key ideas from Keynes. 1. The confidence fairy is real. 2. If confidence remains depressed, high unemployment can exist forever. My new Vox piece, coauthored with Konstantin Platonov, presents the key findings of the paper in simple language. Here is a link to our paper, Animal Spirits in a Monetary Economy.VOX piece...

Larry Summers has argued that market economies may get stuck in permanently inefficient equilibria. He calls this 'secular stagnation' (Summers 2014). In this equilibrium, unemployment may be permanently ‘too high’ and output may remain permanently below potential, because private investors are pessimistic about the prospects for future growth. Our most recent research attempts to explain why secular stagnation occurs and how economic policy may be used to escape it (Farmer and Platonov 2016)

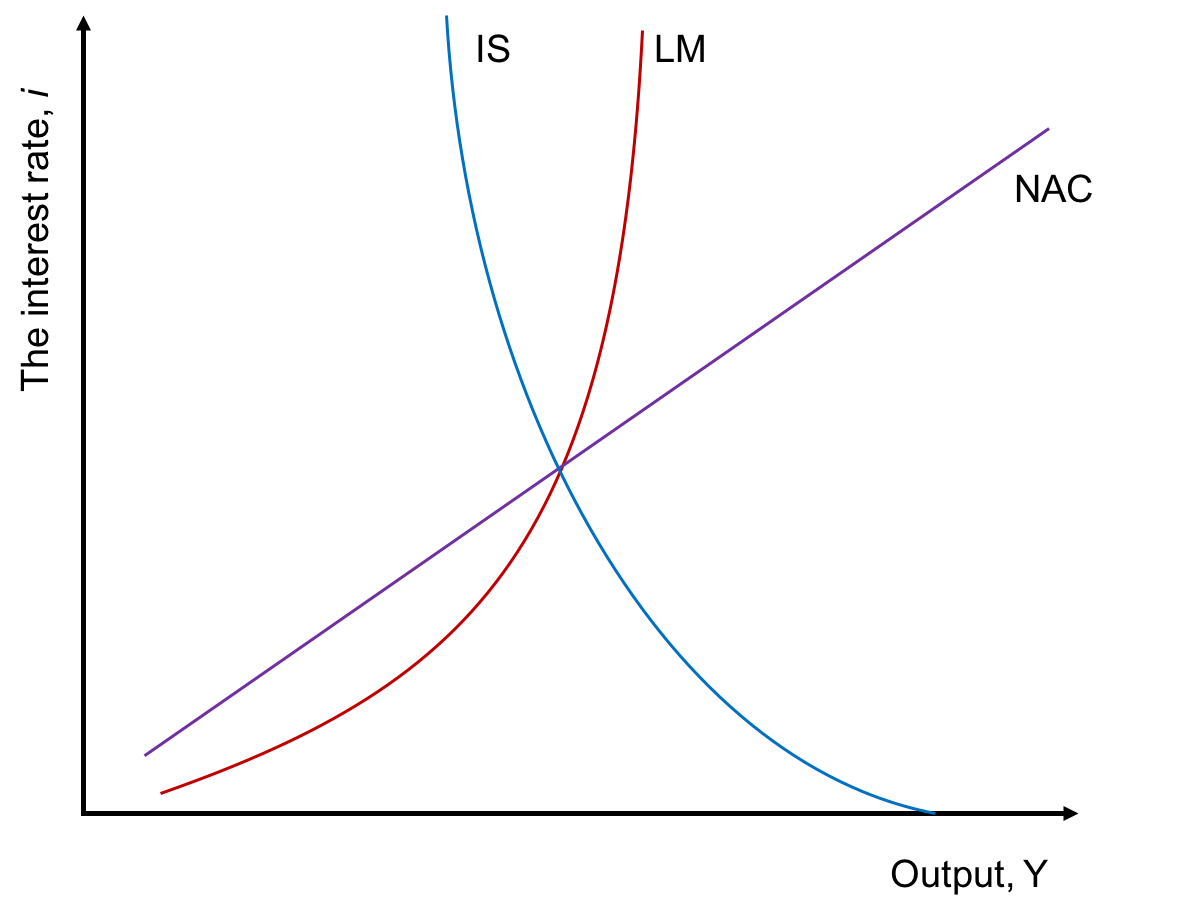

In the wake of the Great Recession, macroeconomic orthodoxy is under attack. Paul Krugman (2011) has called for a return to the IS-LM model, an approach that was developed by Sir John Hicks (1937). We are sympathetic to that call but we believe that the IS-LM model needs to be redesigned. We suggest a different way of thinking about the effect of monetary policy that we call the 'IS-LM-NAC' model. It is part of a broader research agenda ( Farmer 2010, 2012, 2014, 2016a, 2018) that studies models in which beliefs independently influence outcomes.... continue reading

Here is a link to our paper, Animal Spirits in a Monetary Economy.