I've followed, with a great deal of interest, the debate between John Cochrane and Paul Krugman. I have a lot in common with both of them.

I agree with Paul that, for the most part, the IS-LM model provides the right answer to policy questions. I agree with John, that we have learned a lot since 1955, when Paul Samuelson invented the Neo-classical synthesis.

But there were a couple of ideas in the General Theory that have been buried by MIT macro. The first, and most important, is that high unemployment is an equilibrium. Repeat after me. E-Q-U-I-L-I-B-R-I-U-M. The second is that animal spirits are an independent causal factor that determines which equilibrium the private economy will select.

Let me ask a simple question that you should feel free to answer. And do please also try to guess the PK and JC answers. (To answer this question, you will need to arm yourself with a knowledge of the textbook IS-LM model. A good introduction would be Greg Mankiw's textbook or, the book I learned from, the intermediate text by Dornbusch, Fischer and Starz.)

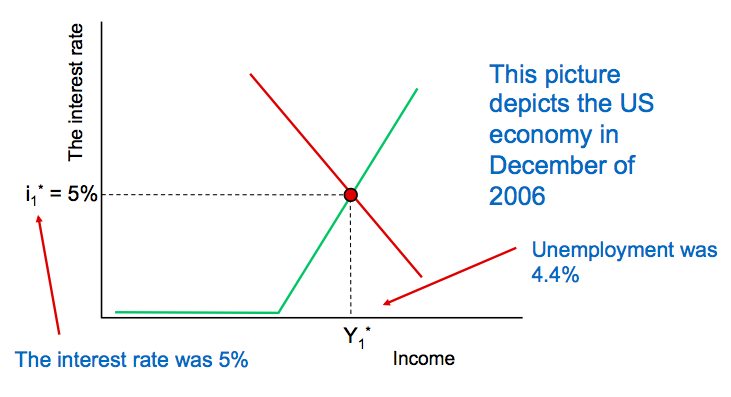

Start from a world with no inflation, and no expected inflation. Suppose that the IS curve intersects the LM curve at a position where the interest rate on T-Bills is 5% and unemployment is 4.4%. This is pretty much where we were in December of 2006, as depicted in Figure 1. (Yes I know the zero expected inflation assumption is not quite right, but thats a bell and a whistle).

If you measure Real GDP (equal to real income) by dividing nominal GDP by the money wage (as I do here and as Keynes advised in the GT) you may plot the stationary value of GDP in wage units on the horizontal axis. That will be at 95% of its maximum value. (Incidentally, this is not synonymous with GDP deflated by the price level, even in a one-good economy).

Now suppose that the initial drop in asset values gets much much worse as the crash in house values hits the balance sheets of financial institutions. Initially, those institutions were baled-out by the treasury but after the collapse of Lehman Brothers, US financial institutions were left to fend for themselves. The situation, post Lehman Brothers, is depicted in Figure 3.

Ok. Here’s the question.

I agree with Paul that, for the most part, the IS-LM model provides the right answer to policy questions. I agree with John, that we have learned a lot since 1955, when Paul Samuelson invented the Neo-classical synthesis.

Let me ask a simple question that you should feel free to answer. And do please also try to guess the PK and JC answers. (To answer this question, you will need to arm yourself with a knowledge of the textbook IS-LM model. A good introduction would be Greg Mankiw's textbook or, the book I learned from, the intermediate text by Dornbusch, Fischer and Starz.)

|

| Figure 1 |

Start from a world with no inflation, and no expected inflation. Suppose that the IS curve intersects the LM curve at a position where the interest rate on T-Bills is 5% and unemployment is 4.4%. This is pretty much where we were in December of 2006, as depicted in Figure 1. (Yes I know the zero expected inflation assumption is not quite right, but thats a bell and a whistle).

If you measure Real GDP (equal to real income) by dividing nominal GDP by the money wage (as I do here and as Keynes advised in the GT) you may plot the stationary value of GDP in wage units on the horizontal axis. That will be at 95% of its maximum value. (Incidentally, this is not synonymous with GDP deflated by the price level, even in a one-good economy).

Now suppose that the IS curve shifts to the left as a consequence of a crash in house prices caused by a loss of confidence that prices will continue to keep going up. Suppose that there is no corrective fiscal action and that the Fed allows the interest rate to fall by lowering interest rates as GDP collapses.

The textbook theory says that we will slowly track down the LM curve, and as people lose their jobs, demand will fall, supply will fall, and we will end up at a new lower level equilibrium. The key word here is equilibrium. This is the prediction of the Hicks-Hansen model before it was polluted by Samuelson’s neoclassical synthesis. That's pretty much what happened between December of 2006 and September of 2008, and thats what I show in Figure 2.

The textbook theory says that we will slowly track down the LM curve, and as people lose their jobs, demand will fall, supply will fall, and we will end up at a new lower level equilibrium. The key word here is equilibrium. This is the prediction of the Hicks-Hansen model before it was polluted by Samuelson’s neoclassical synthesis. That's pretty much what happened between December of 2006 and September of 2008, and thats what I show in Figure 2.

|

| Figure 2: |

|

| Figure 3: |

If the Fed keeps the interest rate at zero, and IF ANIMAL SPIRITS REMAIN PESSIMISTIC: What will happen to GDP, the interest rate, inflation and real wages, once we have reached the new lower steady state (Y3 on Figure 3)? My answer is nothing. Repeat after me. N-O-T-H-I-N-G.

Long before it became fashionable, I made the distinction between old Keynesian and new Keynesian economics. Using my definition, old Keynesians would assert that there are many steady state unemployment rates. In contrast, new Keynesians view high unemployment as a disequilibrium caused by sticky prices. They agree with John that there is a unique natural rate of unemployment, determined by supply side factors, and that the private economy is gravitating towards that rate. They disagree on the speed of adjustment and in the role of government in achieving that adjustment.

It ain't so. There is no natural rate of unemployment in the sense that Friedman used that term. But by accepting some version of the Neo-classical synthesis, both John and Paul are agreeing that Say’s Law holds in the long run. Supply creates its own demand. By accepting Samuelson’s interpretation of the GT, Paul is playing in John’s backyard.

If we don't accept the MIT worldview: how do we reconcile Keynesian economics with Walras? My answer explained here, is that multiple equilibria arise as a result of missing factor markets. I explain WHY there can be multiple equilibria where there is no incentive for firms to change wages and prices. High unemployment, in the absence of a recovery in animal spirits, is an equilibrium in the sense in which physicists use this term. This is not rocket science. But you do have to read my work, rather than assume you know what it says, in order to get this point.