John Cochrane responds to my piece on why there is no evidence that the economy is self-correcting with an excellent blog post

on unit roots. John's post raises two issues. The first is descriptive statistics. What is a parsimonious way to describe the time series properties of the unemployment rate? Here we agree. Unemployment is the sum of a persistent component and a transitory component.

The second is economics. How should we interpret the permanent component?

I claim that the permanent component is caused by shifts from one equilibrium to another and that each of these equilibria is associated with a different permanent unemployment rate. I’ll call that the “demand side theory”. (More on the data here and here and my perspective on the theory here and here ).

Modern macroeconomics interprets the permanent component as shifts in the natural rate of unemployment. I’ll call that the “supply side theory”. That theory is widely accepted and, in my view, wrong. As I predicted in the Financial Times back in 2009, "the next [great economic idea] to fall will be the natural rate hypothesis".

Lets start with the statistics.

In the comments section, (always worth reading beyond the main post) John and I are in complete agreement that unemployment has two components. One is highly persistent, and well approximated by a random walk. The other is stationary.

Here is John

Hi Roger. We’re converging. Yes, there is an interesting low frequency component in unemployment, that might be modeled well in a short sample with a random walk (unit root = random walk plus stationary component). And unit root asymptotics might be a better approximation to finite sample distributions, plus warn of biases like the AR(1) coefficient.

A random walk, as its name suggests, has an equal chance of going up or down. A stationary variable always returns to a constant number. What about a series that is the sum of a random walk and a stationary component? The stationary bit is always pulling the unemployment rate back to something: but that something is not a number, it’s the random walk component. Unemployment is aiming at a moving target.

John has his own unit root tests. In John's words

"Look at the plot" and "think about the units"

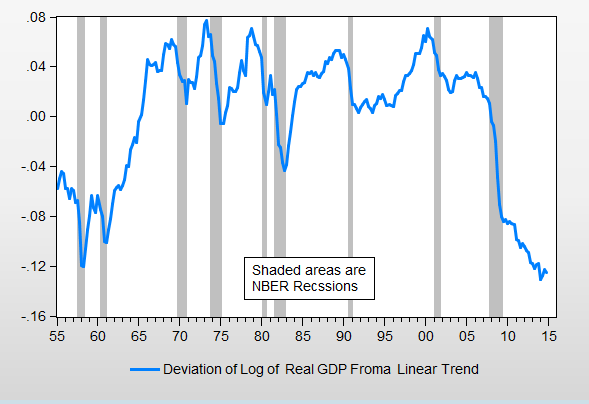

I like that. Here is my “look at the plot” diagram seen through the lens of John’s comment that a unit root equals a “random walk plus stationary component”

John's Unit Root Test:

"Look at the Plot":

The blue line is the unemployment rate since 1949, the grey shaded areas are the eleven post-war NBER recessions, and the red lines are the means of the unemployment rate for each of the eleven post-war expansions. Because unemployment has a “low frequency component”, the number the economy converges to is different after every recession. It is not a single number. It is a moving target.

So much for the statistics: What about the economics? The central question for policy makers and their academic advisors should be: Why is the target moving? My answer is that aggregate demand, driven by animal spirits, is pulling the economy from one inefficient equilibrium to another. My theoretical work explains how that idea is consistent with the rest of economic theory.

The orthodox answer, one we have taught to graduate and undergraduate students alike for the past fifty years is that aggregate supply is shifting from one decade to the next, pushed by changing demographics, shifting tax policies and technological change.

If permanent movements in the unemployment rate are caused by shifts in aggregate demand, as I believe, we can and should be reacting against these shifts by steering the economy back to the socially optimal unemployment rate. If instead, these movements are caused by shifts in aggregate supply, the moving target is the socially optimal unemployment rate.

John has not yet staked out a position. On this point he says…

I don't have a definite opinion. There is lots of interesting, new, and unexplored economics on that one. I'll read your paper!

Paul Krugman weighed in on this debate and he claims to agree with John about the statistics, although I’m not sure he read the comments section.

John and I are in complete agreement: there is a permanent component in the unemployment rate. That component requires an explanation. Is it demand or is it supply? The answer to that question has huge implications for policy.

Tired old 1950's theory would attribute the permanent component in unemployment to unavoidable natural rate shifts. Shiny new Neo-Paleo-Keynesian theory would attribute the permanent component to avoidable shifts in animal spirits. Which is it Paul: Demand or Supply?